Looking for a good invoice billing software in Nigeria? We’ve got you!

Running a business in Nigeria today is an uphill battle, where you are expected to stay ahead with smart, automated solutions if you want to be successful or remain relevant.

One area you can’t afford to overlook is invoice billing software.

Gone are the days of manual invoicing that leads to delayed payment and costly errors.

In 2026, businesses need fast and reliable billing systems that keep cash flow smooth.

With innovations like crypto invoicing platforms entering the market, Nigerian businesses now have more options to accept payments in local currency and cryptocurrency.

In this guide, we’ll go over why invoice billing software matters, the key features you should look for, and the top 11 invoice billing software platforms in Nigeria.

Related:

- How to Generate a Free Bitcoin Invoice

Why Invoice Billing Software Matters for Nigerian Businesses

In Nigerian businesses today, accuracy and efficiency are non-negotiable.

It doesn’t matter if you run a small boutique, a mid-sized consulting firm, or a large enterprise in Nigeria, invoicing is the foundation of your cash flow.

Unfortunately, many businesses still rely on manual billing methods, which are known for constant errors, delays, and financial losses.

Here’s why switching to invoice billing software is a smart choice for Nigerian businesses:

1. Automation Saves Time and Reduces Errors

Manual invoicing takes hours and increases the risk of mistakes like wrong amounts, missing details, or late delivery.

With invoicing software, you can automate invoice generation, recurring billing, and payment reminders, making time for you to focus on other aspects of your business.

2. Professionalism Builds Trust

Clients expect accuracy and professionalism.

A good invoice billing software ensures proper recordkeeping and strengthens your brand image.

No more handwritten receipts or disorganized spreadsheets.

3. Faster Payments and Better Cash Flow

When invoices are delayed, payments are equally delayed.

Billing software sends instant invoices, offers multiple payment options, and automatically follows up on pending payments.

4. Compliance and Tax Management

With Nigeria’s tax regulations constantly changing, businesses must keep accurate financial records.

Invoice billing software helps to automatically calculate taxes, making compliance easy.

5. Scalability for Growth

As your business grows, manual invoicing becomes difficult to manage.

Modern invoicing tools are scalable, handling thousands of invoices easily without compromising speed or accuracy.

Key Features to Look Out For

Before choosing an invoice billing software for your Nigerian business, it’s important to know what features matter most.

Here are the top things to consider:

1. Ease of Use and Quick Setup

Your invoicing software should be simple and intuitive, even for users that are not tech savvy.

Look for tools with a clean dashboard, easy navigation, and fast onboarding so you can start sending invoices in minutes.

2. Customization Options

Your invoices should reflect your brand identity.

A good billing software should allow you to add your logo, colors, and brand elements.

You should be able to customize fields and include payment terms.

3. Local and Multiple Payment Options

In Nigeria, customers use various payment methods like bank transfers, cards, USSD, and now crypto.

The best invoice billing software should support naira payments, local gateways like Paystack, and crypto payments.

4. Reporting and Analytics

If you want a very good invoicing software, then you should go for one that allows you to track payments, view sales reports and expense tracking, and export options for accounting and tax purposes.

5. Mobile Accessibility

Your business should not stop the moment you leave your office.

Many businesses in Nigeria have shifted mode of operations to online systems.

You should use a platform with a mobile app or responsive web version so you can create, send, and track invoices.

6. Security and Data Protection

The most important aspect of your business is your financial data, as it is very sensitive.

Ensure to use tools that use secure encryption, two-factor authentication, and comply with global standards to keep your information safe.

Top Pick:

Top 11 Invoice Billing Software in Nigeria

The Nigerian market offers various invoicing tools designed for small businesses and large enterprises.

Below are the top 11 invoice billing software solutions you should consider, including one unique platform that allows crypto invoicing.

- Zoho Invoice

- Breet

- QuickBooks Online

- Invoice Simple

- Wave Accounting

- FreshBooks

- Sage Business Cloud Accounting

- Paystack Invoice

- Flutterwave Invoice

- Invoice NG

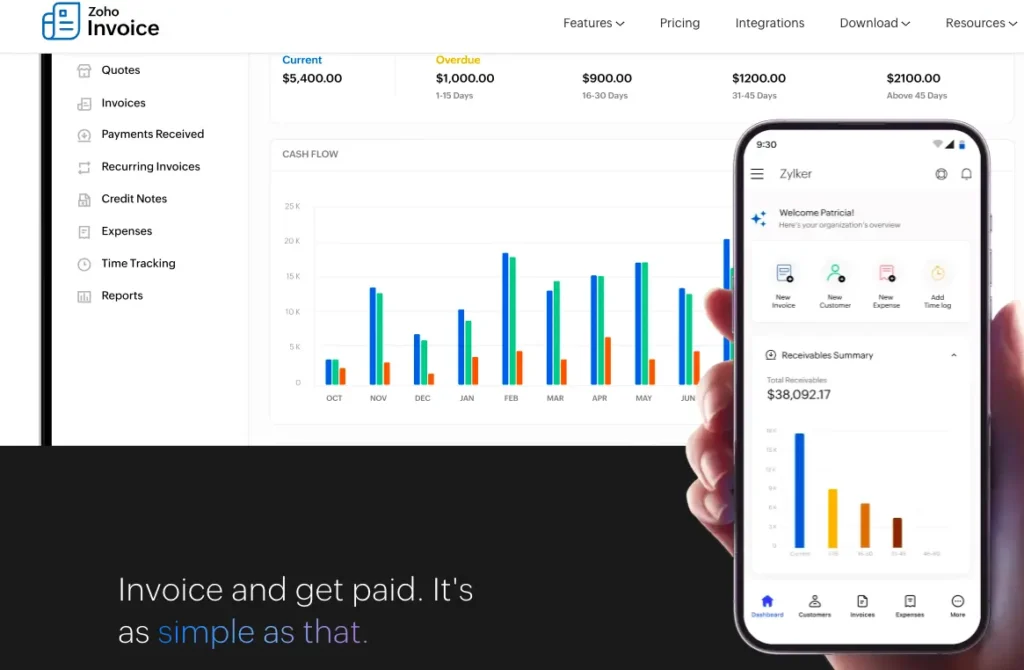

1. Zoho Invoice

Best For: Zoho Invoice is best for SMEs and businesses that need strong automation and good invoice billing software.

Key Features:

- Customizable templates

- Automated reminders and recurring billing

- Multi-currency support

- Integration with Zoho ecosystem (CRM, Books)

Pricing: Free for up to 1,000 invoices/year

2. Breet (Crypto Invoicing Platform)

Best For: Businesses accepting crypto payments and for instant Naira settlement

Unique Feature: With Breet, you can create professional invoices, share them with clients globally, and receive payments in cryptocurrency, automatically converted to Naira in your bank account at the best rates in 287 seconds.

Other Features:

- Easy invoice creation and sharing

- No hidden charges

- Zero volatility risk (crypto converted instantly to Naira)

- Secure, fast settlements

Pricing: Free to use

Related:

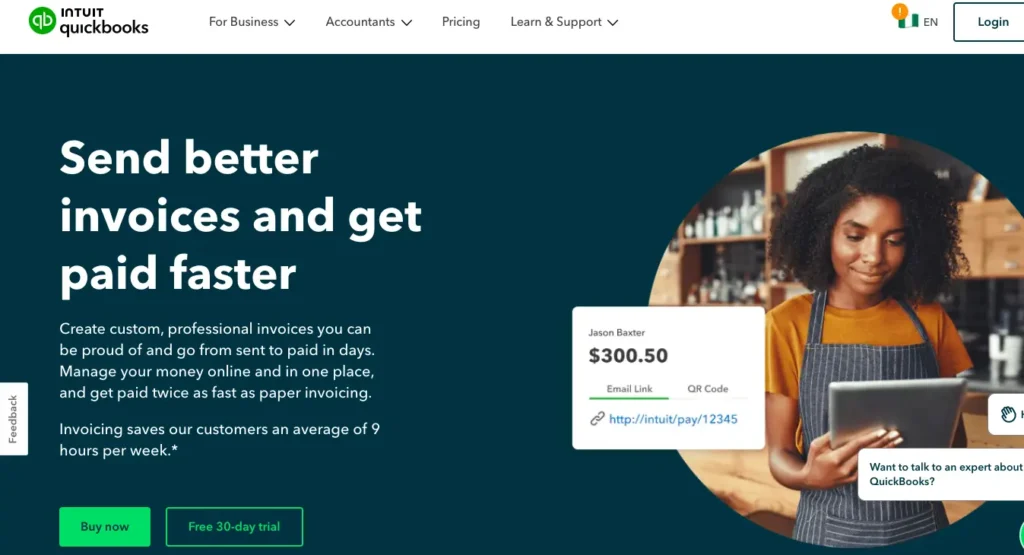

3. QuickBooks Online

Best For: Businesses that need integrated accounting and invoicing

Key Features:

- Invoice billing software with automatic invoice tracking and reminders

- Integration with payroll and inventory

- Mobile-friendly interface

Pricing: Starts at $19/month with a 30 days free trial

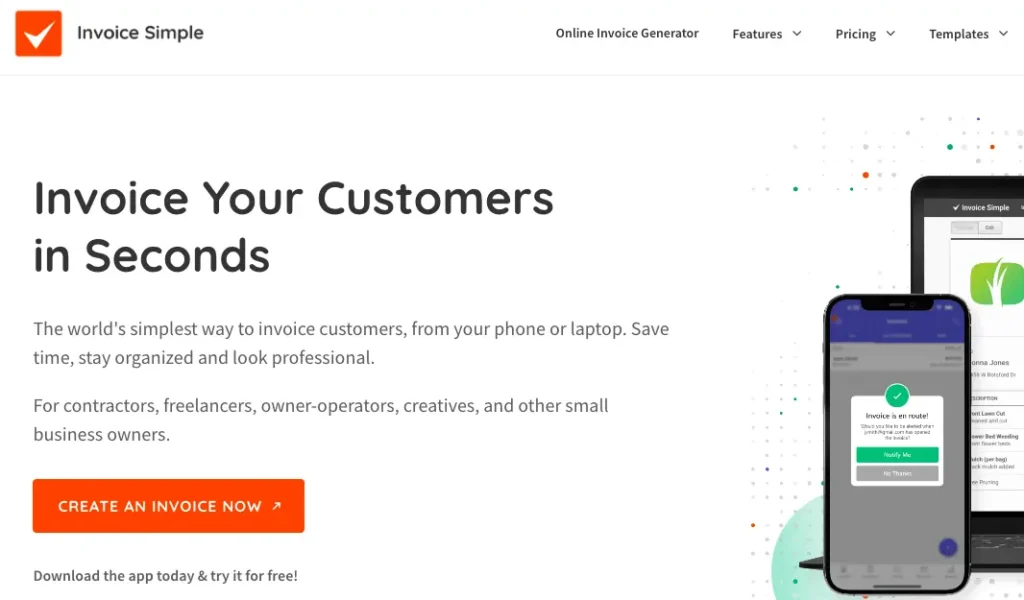

4. Invoice Simple

Best For: Freelancers and small businesses needing a quick invoicing solution

Key Features:

- Simple invoice creation on mobile or desktop

- Multiple payment options

- PDF invoice sharing via email or WhatsApp

Pricing: Starts at $4.99/month.

5. Wave Accounting

Best For: Small businesses on a budget looking for cost-effective invoice billing software

Key Features:

- Free invoicing and accounting

- Recurring billing and reminders

- Mobile app for on-the-go invoicing

Pricing: Free

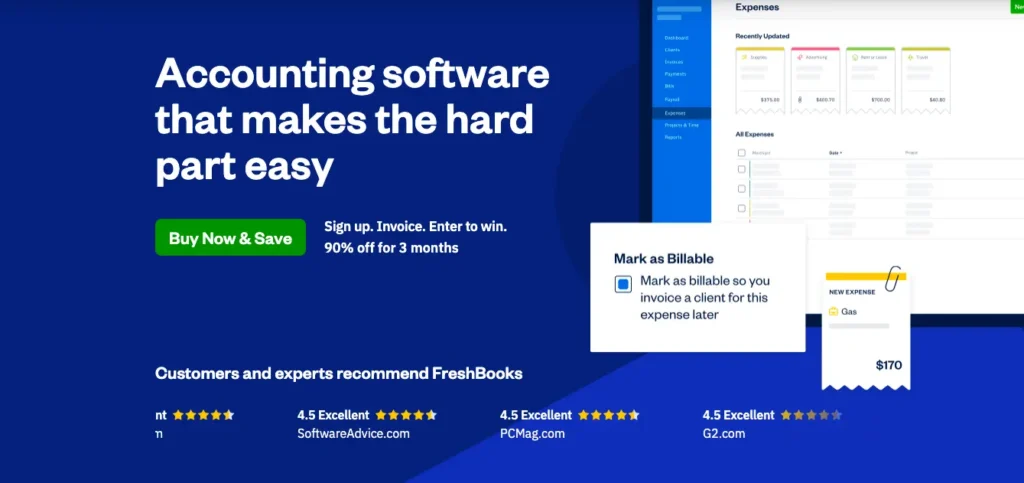

6. FreshBooks

Best For: Service-based businesses and consultants

Key Features:

- Time tracking and project-based invoicing

- Expense management

- Client portal for payments

Pricing: Starts at $21/Month. Offers 90% off for 3 months.

For You:

- 9 Best Bitcoin Exchange Sites in Nigeria, Ranked

7. Sage Business Cloud Accounting

Best For: Established businesses needing compliance and tax-friendly features

Key Features:

- Professional invoice templates

- Invoice billing software with financial reporting and VAT calculation

- Integration with payroll

Pricing: From $12/month

8. Invoicely

Best For: SMEs and multiple businesses owner

Key Features:

- Supports multiple businesses under one account

- Custom branding

- Real-time currency conversion

Pricing: Free plan; paid plans start at $9.99/month

9. Paystack Invoice

Best For: Businesses already using Paystack for payments

Key Features:

- Easy integration with Paystack payment links

- Automated invoice tracking

- Instant payment confirmation

Pricing: Free; Paystack charges per transaction

10. Flutterwave Invoice

Best For: Businesses using Flutterwave for local and international transactions

Key Features:

- Multi-currency invoicing

- Integration with Flutterwave payment gateways

- Customizable templates

Pricing: Free; transaction fees apply

11. Invoice NG

Best For: Local Nigerian businesses wanting a simple invoice billing software

Key Features:

- Local payment support

- Professional templates

- Simple dashboard for SMEs

Pricing: Free to use; paid starts at ₦1,500/month

Don’t Miss:

- 9 Best Crypto OTC Trading Platforms

Comparison Table: Top 11 Invoice Billing Software for Businesses in Nigeria

| Software | Pricing / Payment Model | Standout Strengths |

| Zoho Invoice | Free for up to 1,000 invoices/year | Comprehensive accounting suite, automation, scalability, integrations |

| Breet (Crypto Invoicing) | Free to use | Only platform offering crypto invoicing with instant Naira conversion, detailed analytics, |

| QuickBooks Online | Starts at $19/month with a 30 days free trial | End-to-end accounting and invoicing with payroll and inventory |

| Invoice Simple | Starts at $4.99/month | Mobile-first, simple interface, QR code payments for solopreneurs |

| Wave | Free | Free invoicing with payment support, good for tight budgets |

| FreshBooks | Starts at $21/month with 90% off for 3 months | Time-tracking, expense management, strong for service-based businesses |

| Sage Business Cloud | Approx ₦6,500+/month | VAT-ready, payroll integrations, enterprise-level reporting |

| Invoicely | Free plan, paid plan starts at $9.99/month | Supports multiple business owners, currency conversion |

| Paystack Invoice | Free to use (Paystack transaction fees apply) | Easy Paystack integration for Nigerian businesses |

| Flutterwave Invoice | Free to use (Flutterwave fees apply) | Multi-currency invoicing linked to Flutterwave payment system |

| Invoice NG | Free plan; Basic ₦1,500/month; Premium ₦2,500/month | Local pricing, multiple businesses per account, reminder automation |

Benefits of Using Invoice Software Over Manual Billing

Automated invoice billing software offers transformative advantages over spreadsheets or paper invoices.

Here’s exactly why your business in Nigeria should make the switch.

1. Faster Payments

- Automatic delivery: Send invoices instantly by email, SMS, or WhatsApp.

- Automated reminders: Set friendly late-payment reminders so you’re not chasing clients.

- Multiple payment options: Traditional bank transfers, mobile money, and even crypto speed up cash flow.

2. Reduced Errors and Improved Accuracy

- Pre-filled templates: Input once and generate invoices consistently

- Auto-calculated taxes (VAT/GST): Save time and reduce compliance risk with correct tax requirements.

- Error reduction: Manual data entry errors can cost you money.

3. Enhanced Professionalism and Brand Trust

- Custom templates: Add logos, payment terms, brand colors, and contact details.

- Digital formatting: Clean, easy-to-read PDFs or emails stand out compared to handwritten or generic text.

- Client perceptions: Good invoices present your brand as organized and trustworthy.

4. Better Record-Keeping for Compliance and Growth

- Automatic data saving: All invoices, payment statuses, tax details, and client info are stored safely in one place.

- Searchable history: Find old invoices easily.

- Easy reporting: Export invoices, revenue data, and tax information directly into accounting systems or for filing GST.

5. Scalability Without Extra Effort

- Multi-user support: Allow your team to generate and track invoices simultaneously without errors.

- Handles high volume: The software handles growing demand without slowing performance.

- System integrations: Link with accounting, CRM, or productivity tools for easy operations.

6. Access to Unique Features Like Crypto Invoicing

- Breet stands out with its crypto invoicing in Nigeria. Clients can pay in Bitcoin, USDT, or other cryptocurrencies, and Breet auto-converts the funds to Naira in 287 seconds.

- It opens global payment options and positions your business for financial flexibility.

Choosing the Best Option for Your Business

The right invoice software isn’t “one-size-fits-all.” Your business size, industry, and budget determine what works best for you. Here’s a simple guide:

1. For Small Businesses and Startups

- What to focus on: Affordability and simplicity. Choose software with free plans or low-cost subscriptions that allow quick setup and basic automation.

- Recommended features: Basic templates, local payment support, and easy customization.

- Why: At this stage, you need a tool that saves time, reduces manual work, and doesn’t take away your profit.

2. For Medium and Growing Businesses

- What to focus on: Scalability and advanced features. Look for platforms that support multiple payment options, recurring billing, and automated reminders.

- Recommended features: Integration with accounting tools and analytics dashboards.

- Why: As you grow, managing multiple clients and payments becomes time-consuming and difficult, which is where automation comes in.

3. For Large Enterprises and Exporters

- What to focus on: Global compatibility and security. You need multi-currency support, crypto payment options, and good reporting.

- Recommended features: API integrations, high-grade security, and custom workflows.

- Why: High transaction volumes demand reliability, compliance, and flexibility.

5.4 For Freelancers and Service Providers

- What to focus on: Quick invoicing and flexible payment options. A platform that allows you to send professional invoices instantly and accept multiple payment methods, including crypto.

- Recommended features: Mobile access, invoice tracking, and easy sharing via email or WhatsApp.

Budget Tip: Start with an invoice billing software that matches your current revenue level, not the most expensive tool on the market. Most businesses overspend on features they never use.

For You:

- The Best 9 USDT Trading Platforms, Ranked

Why Breet is the Best Crypto Invoice Billing Software in Nigeria

When it comes to invoice management, you don’t just need software, you need a complete solution that combines speed, security, and flexibility.

That’s exactly what Breet delivers.

Here’s why thousands of Nigerian businesses trust Breet for invoicing:

- Instant Invoicing in Seconds: You have access to an easy setup. Generate a professional invoice in under 60 seconds from your mobile app or desktop.

- Multiple Payment Options: Accept payments through crypto, Naira, or bank transfer. Also, Breet automatically converts crypto to Naira, removing the risk of volatility.

- 100% Free to Start: Breet is free to use with no hidden charges, making it perfect for startups, freelancers, and SMEs.

- Advanced Features for Growing Businesses: From payment reminders to automated tracking and detailed reports, Breet grows with your business needs.

- Built for Nigerian Businesses: Unlike foreign tools that don’t fully support local payment methods, Breet is made for Nigeria’s business environment, ensuring smooth transactions and compliance.

Frequently Asked Questions on Invoice Billing Software for Businesses in Nigeria

What is the best invoice billing software for small businesses in Nigeria?

Zoho, Paystack, Flutterwave and Breet (strictly for crypto invoice) are the best invoice software for Nigerian small businesses that offers simple invoicing, multiple payment options, VAT compliance, and affordable pricing.

Do I need invoice software if I already use Excel?

Yes. Excel can work for basic invoices, but it lacks automation, tax compliance, payment tracking, and digital security. With Nigeria moving toward mandatory e-invoicing, businesses will need software that automates VAT calculations and meets FIRS requirements to avoid penalties.

How do I choose the right invoice software for my business?

Start by considering your business size, industry needs, budget, and compliance. This helps you make the right choice based on your needs.

What should a proper invoice include in Nigeria?

A Nigerian VAT-compliant invoice must have:

- Your TIN and VAT number

- Client details

- Description of goods/services

- 7.5% VAT amount

- Total payable

Using invoicing software ensures these details are automatically added to every invoice.

Which invoicing software accepts payments in Naira and crypto?

Breet is one of the few solutions that allows businesses to accept crypto payments, alongside Naira transactions, giving clients multiple ways to pay.

Don’t Miss:

- USDT TRC20 Contract Address: What is it & How to Get it?

Conclusion

In today’s business environment, manual invoicing is no longer the way to go, if you want an easy, successful business.

Either you are a SME or large enterprise in Nigeria, using the right invoice billing software can save you time, reduce errors, and improve cash flow.

From automation to multiple payment options, the tools we’ve reviewed can change the way you handle billing.

However, if you want an all-in-one solution made specifically for Nigerian businesses, with crypto payment support, instant conversions, and zero subscription fees, then Breet is your best choice.

Ready to make smart choices? Start sending professional invoices today!