Back in 2021, SafeMoon was the most hyped crypto project around. It was everywhere from Twitter to Reddit to TikTok. Most thought it was the best thing after Bitcoin. The price was skyrocketing and everybody was “holding to the moon”.

In the background, however, Safemoon wasn’t a technological miracle or an overly innovative token with massive utility.

It was more hype than substance. But with a huge community and social media hype behind it, it was doing numbers.

Eventually, its real value came to the forefront which led to a collapse that made many investors and holders lose billions of dollars cumulatively.

In this article, we’ll look at exactly what happened to Safemoon, if Safemoon is worth anything, why it rose the way it did, its eventual crash and the lessons we, as the crypto community, learned from it.

Related:

- Top 11 ways to Recover Lost or Stolen Bitcoin From Scammers

What is Safemoon Crypto?

Safemoon crypto is a cryptocurrency developed by the Safemoon team in early 2021, built on the Binance Smart Chain (BSC).

It was introduced as a community-driven token with unusual tokenomics meant to reward long-term holders. A core part of its design was a 10% fee charged on every sale, known as a “reflection” fee. Half of this fee was automatically added to the project’s liquidity pool, while the other half was redistributed to existing holders.

This structure aimed to encourage “diamond hands,” reduce sell pressure, and create a sense of stability in the token’s price.

This combination of simple messaging and seemingly innovative mechanics caught the attention of many new crypto users.

To beginners, the idea of earning passive rewards just by holding the token sounded exciting. And to others, the complex tokenomics made Safemoon appear more advanced than the average meme token, helping it quickly build a large and enthusiastic community.

As Safemoon gained traction, it began spreading rapidly through YouTube, Twitter, and Telegram. Influencers and crypto content creators amplified the hype, often presenting it as an opportunity to “get in early on the next Bitcoin.”

Thousands of people bought the token based solely on this buzz, with many never taking the time to review the whitepaper or understand the underlying risks.

The Rise of SafeMoon

The launch of Safemoon came at the perfect time. Record number of newbies were being onboarded into crypto, social media was buzzing following the craze of the pandemic, social media marketing was at an all time high and the crypto community was just coming out of the “Dogecoin era” and people were eager for their first 1xxxx% profits.

And that was exactly what Safemoon offered. Massive profits. Even its name suggests it can make you rich by just hodling.

By April 2021, around a month after its official launch, it had already given early investors profits in thousands of percent.

And they took to social media. Everybody was posting gains and everyone else was feeling the FOMO heavily. So, a new influx of buyers came in hoping to catch the next bull.

On Safemoon’s team’s side, they were quick to dispel any talks about Safemoon being a meme or social media coin with a steady stream of news and information about future developments and a focus on long term success.

Asides the cryptocurrency they were working on a native wallet, an exchange and even an entire blockchain.

But eventually hype dies down, it always does. The only thing that keeps a project afloat after that is utility, which Safemoon didn’t have.

Top Pick:

- Bitcoin Scams: Biggest Stories & How to Identify Them

The Downfall: What Went Wrong with SafeMoon Crypto?

Key issues that led to Safemoon’s collapse:

- Repeated delays and failed product launches

- Lack of transparency around liquidity pool control

- Accusations of mismanagement from former team members

- Loss of investor confidence and massive sell-offs

Now, let’s do a deep dive into what happened to Safemoon Crypto

1. Missed Deadlines and Failed Deliverables

By June 2021, early warning signs started showing. The Safemoon wallet, one of the project’s most hyped products, had its launch date shifted multiple times.

Each delay reduced investor confidence, and many began to question whether the team had the capability to deliver on their promises. These repeated setbacks created an atmosphere of uncertainty around the project’s future.

2. Liquidity Pool Concerns and Lack of Transparency

One of the biggest turning points came when investigations revealed that the Safemoon team controlled a large portion of the liquidity pool. This directly contradicted the team’s earlier statements claiming otherwise.

Analysts and regulators, including the SEC, later confirmed these concerns. Controlling the liquidity pool meant they had the technical ability to pull the funds at any time, a classic red flag associated with Crypto rug pulls.

This revelation shook the community’s trust.

3. Growing Distrust and Falling Token Price

As doubts spread, many holders began selling their tokens.

Investor confidence declined rapidly, and Safemoon’s price started to fall. Those who continued holding saw their portfolios shrink painfully as the token lost a significant portion of its value.

The once-strong “diamond hands” narrative weakened as fear replaced optimism.

4. Internal Conflicts and Public Accusations

The situation worsened when former Safemoon team members came forward with allegations of mismanagement of funds.

These internal disputes, made public across social media and crypto forums, added fuel to the panic.

Rumours, leaked conversations, and internal drama made it harder for investors to believe in the project’s leadership.

5. Massive Losses for Holders

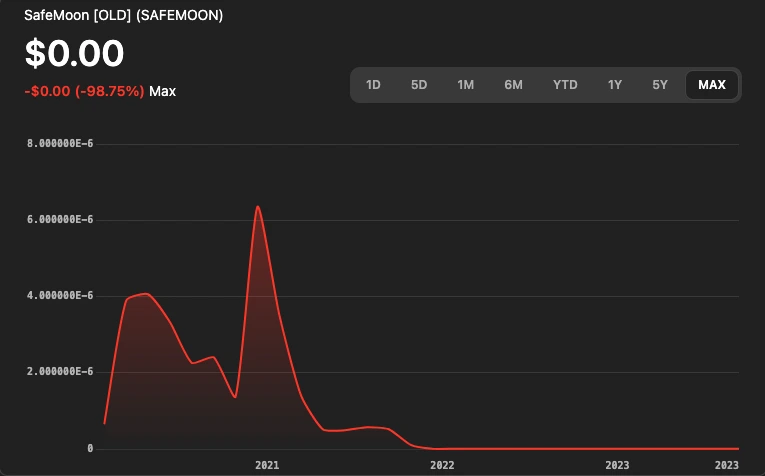

Between Q3 2021 and late 2022, Safemoon’s price collapsed by more than 90%. Many early believers who held through the turbulence ended up losing most of their investments.

What started as one of the fastest-growing communities in crypto ultimately became a cautionary tale about hype, transparency, and due diligence.

Related:

- OneCoin Cryptocurrency Scam: A Timeline of Events and Impact

Is Safemoon Crypto Still Working?

Yes, Safemoon still technically exists, but it is no longer functioning as an active or reliable crypto project. Development has slowed down significantly, trading activity has dropped, and the project has faced serious legal, technical, and community-trust issues. For most investors, Safemoon is considered inactive and largely abandoned.

Safemoon’s blockchain contracts still operate because they are decentralized, meaning the token can still be traded on certain platforms.

However, the core project itself: the team, updates, roadmap delivery, and product development, have not been functioning in any meaningful way.

1. Development Has Stalled

Safemoon’s major products, such as its wallet, exchange promises, and upgrades, have seen little to no progress. Many expected features were never delivered, and the team’s online presence has greatly reduced.

2. Community and Trading Volume Have Shrunk

The once-active Safemoon community has become fragmented. Trading volume and liquidity on major platforms dropped sharply, making the token far less usable or profitable to trade.

3. Legal and Regulatory Issues

Safemoon has been involved in investigations and lawsuits, which further stalled development and scared off new investors. These legal troubles have damaged the project’s credibility and momentum.

4. Price Has Not Recovered

Despite occasional small spikes in activity, Safemoon has not regained its former value. The token remains over 90% down from its highs, and most analysts classify it as a failed project.

5. Considered a High-Risk Token

While holders can still buy or sell the token, the lack of updates, shrinking liquidity, and unresolved controversies make it a high-risk asset with very little long-term potential.

You Might Like:

- 13 Best Crypto Faucets That Actually Work

Is Safemoon Coin Worth Anything?

Safemoon (SFM) is still technically tradable, but in practical terms, it holds very little value today. The token exists on some exchanges, and you can still buy or sell it, but its price is extremely low, around $0.0000000081 per token.

Trading volumes and liquidity are minimal, which makes it difficult for holders to convert large amounts back into fiat or other cryptocurrencies.

The token’s original issuing team filed for bankruptcy in late 2023, halting formal operations.

Earlier concerns about liquidity pool control, mismanagement, and allegations of fraud have further damaged investor confidence. As a result, Safemoon has lost nearly all of its peak value and no longer functions as a reliable or actively maintained project.

For current holders, this means that while SFM has some nominal value, the practical real-world worth is negligible.

For potential buyers, investing in Safemoon now is extremely high-risk, with almost no chance of meaningful returns. Overall, Safemoon remains a cautionary example of a hyped crypto project that failed to deliver long-term value.

Where SafeMoon Stands Today (2025)

Safemoon is still around today but saying it’s a shell of its former self would be an understatement. It went through rebrands and even a whole migration to Safemoon V2 in December of 2021 where their tokens were consolidated in the ratio 1000:1.

However, none of the attempts to revive the project worked.

It is delisted on most of the top crypto exchanges and has next to no trading volume.

Some of their developers are still active on social media but they no longer have traction nor credibility.

In the end Safemoon was a lesson to the crypto community. Not to avoid hype tokens entirely but to be wary. Hype always dies down eventually and projects without a strong utility anchor will always fade away.

You Might Like:

Lessons to Learn From Safemoon

The Safemoon incident did not happen, and to the scale it did, solely because their founders or team were dishonest and misleading with their marketing, it also happened because the investors, made up mostly of crypto newbies, were blind to several red flags.

Here are some of the lessons we learnt:

- Always check utility before apeing in: The initial appeal for Safemoon was its reflection model to discourage selling. Utility was promised with native wallets, exchanges and blockchain networks but none of these materialised. Before buying into a crypto project, check for current and not future or promised utility

- Read the whitepaper and tokenomics: It is really important to understand a project’s token structure before investing long term. According to Safemoons tokenomics, each sale is taxed 10%. Half goes back to holders and the other half was supposed to be put in liquidity. But that half was also halved and one half was converted to BNB and the other half added to their PancakeSwap liquidity pool. Where did the BNB half go?

- Invest only what you can afford to lose in memecoins: It is important to always take memecoins for what they are. Light hearted tokens that have no utility and therefore are extremely volatile. They may rise and give you insane profits but it’s more likely that they will drop massively in value instead.

- Research the team: Always look up the team and their past records and projects. It will save you a lot of money when you understand the people behind the project. Founders who have a history of shady dealings in past projects most likely do it again. Safemoons leadership was charged with fraud and the CTO, Thomas Smith, pleaded guilty.

Conclusion on Safemoon Crypto

Safemoon’s fall was quick and spectacular but let’s be clear it didn’t fail so quickly because it had no utility. The main architect was dishonesty, false marketing and shady dealings internally.

It was built on hype and should have embraced its status as a memecoin rather than empty promises of revolution.

Now, it stands as a relic of crypto’s past to teach the consequences applicable when greed and dishonesty replaces real utility and logic.

The lesson we all learnt from Safemoon is to always do your own research on tokens, read their whitepaper and tokenomics before investing rather than buying in on hype and vibes.

Don’t Miss:

Frequently Asked Questions About Safemoon Crypto

What Caused Safemoon’s downfall?

Loss of trust in the project followed by panic sales were the main causes of Safemoon’s downfall. Accusations of dishonesty and multiple lawsuits and investigations into their leadership, especially the one by the SEC sealed the deal.

What is Safemoon V2?

This is a new version of Safemoon which features updates to their main token smart contract. The tokens were consolidated on a 1000:1 basis meaning 1000 Safemoon tokens become 1 Safemoon token.

Can I Still Invest in Safemoon?

Technically, yes, you can still buy Safemoon on decentralised exchanges but it is discouraged because it has no liquidity.

Was Safemoon a Scam?

Few people may argue it wasn’t an outright scam but the fact is the team was dishonest and they have been legally charged by the United States Department of Justice and the Securities Exchange Commission for securities fraud, wire fraud and money laundering.

Is Safemoon Still Trading Today?

Yes. Even though it is delisted on basically every centralised crypto exchange, you can still buy it on a decentralised exchange like pancakeswap.