If you live in Nigeria and hold crypto, you’ve probably faced the same question most smart holders ask themselves: should I keep my crypto as it is, or convert it to dollars to protect its value?

With the Naira’s unpredictable swings, it’s easy to see why more people are leaning toward the dollar side of things. Converting crypto to USD is a way to preserve the real worth of your digital assets in a stable currency.

Think about it; your Bitcoin or USDT might be worth the same globally, but when measured in Naira, the story changes almost daily. By converting your crypto to dollars, you’re setting yourself up for smoother international transactions, easier savings, and better financial security.

In this guide, we’ll walk through how Nigerians can easily convert crypto to dollars, the best platforms to use, and how to make sure you always get the most value for your money.

Understanding Crypto to Dollar Conversion

Converting crypto to dollars in Nigeria simply means exchanging your digital assets, like Bitcoin, Ethereum, or USDT, for their equivalent value in United States dollars (USD). It is how many people move from the volatility of crypto or local currencies into something more stable and widely accepted.

For Nigerians especially, the idea goes beyond “selling” crypto but about preserving value, managing risk, and unlocking access to global opportunities.

Let’s look at some of the main reasons people convert their crypto to USD.

1. To Protect Value Against Naira Depreciation

The Naira’s constant fluctuation has made it difficult to plan financially. One day your savings can buy a full grocery cart, and a few months later, it might only cover half.

That is why many Nigerians prefer holding or converting their crypto to dollars. It is a way to keep the real value of their money intact.

For example, if you earned $500 worth of Bitcoin from freelance work in January and kept it in Naira, by October that same amount might be worth far less in purchasing power. But if you converted or held it in USD, you might have preserved its true international value.

2. For Business and International Payments

Many freelancers, business owners, and remote workers receive payments in crypto from clients abroad. Converting that crypto into dollars allows them to pay for international services, subscriptions, and suppliers without worrying about currency restrictions or sudden exchange rate spikes.

Imagine you run a design agency in Lagos and get paid in USDT.

By converting your USDT to USD, you can easily use your funds for global platforms like Adobe, Fiverr, or even PayPal-linked accounts without losing value through multiple conversions.

Top Pick:

3. For Savings and Dollar-Based Investments

Holding wealth in USD is often seen as a hedge against inflation. Converting your crypto to dollars gives you a stable base for long-term savings or investment opportunities.

Whether you plan to invest in dollar-denominated mutual funds, stablecoin staking, or simply store value, the dollar remains one of the most reliable options.

This approach is becoming increasingly popular among Nigerians who use platforms like Breet to convert Bitcoin or USDT to dollars, then reinvest or store it safely.

4. For Remittance and Cross-Border Transfers

Sending and receiving money across borders has always been a challenge due to fees and delays. Crypto solved that problem, but not everyone wants to hold their funds in Bitcoin or Ethereum because of price volatility. By converting crypto to USD after receiving it, families and freelancers can enjoy both speed and stability.

For instance, if someone in the U.S. sends $200 worth of USDT to a relative in Nigeria, the recipient can convert that USDT directly to dollars or local currency without worrying about crypto price changes.

5. How Exchange Rates and Stablecoins Come In

When converting crypto to USD, the exchange rate determines how much you actually receive. Crypto prices fluctuate every second, so most conversion platforms automatically use real-time rates to give users the best value.

Stablecoins like USDT (Tether), USDC, or DAI play a huge role in this process.

These coins are pegged to the U.S. dollar, meaning 1 USDT is always roughly equal to 1 USD. Many Nigerians use stablecoins as a “digital dollar,” making it easy to hold, send, or convert funds without losing value to currency swings.

Related:

- Top 15 Crypto Off-ramp Platforms, Compared

Breet: The Best Way to Convert Crypto to Dollars in Nigeria

There are several ways to turn your crypto into dollars in Nigeria, but some methods are easier, faster, and more secure than others. The most convenient option for most people today is using crypto-to-cash apps like Breet.

Breet makes converting your crypto to USD incredibly simple.

You don’t need to find a buyer, chat with anyone, or worry about scams. The app automatically converts your crypto into your chosen currency at the best rate available. It’s quick, secure, and designed for everyday users who just want an easy way to cash out.

Here’s how to convert Crypto to USD in Nigeria, using the Breet app:

- Download and sign up on Breet. You can find it on both Android and iOS.

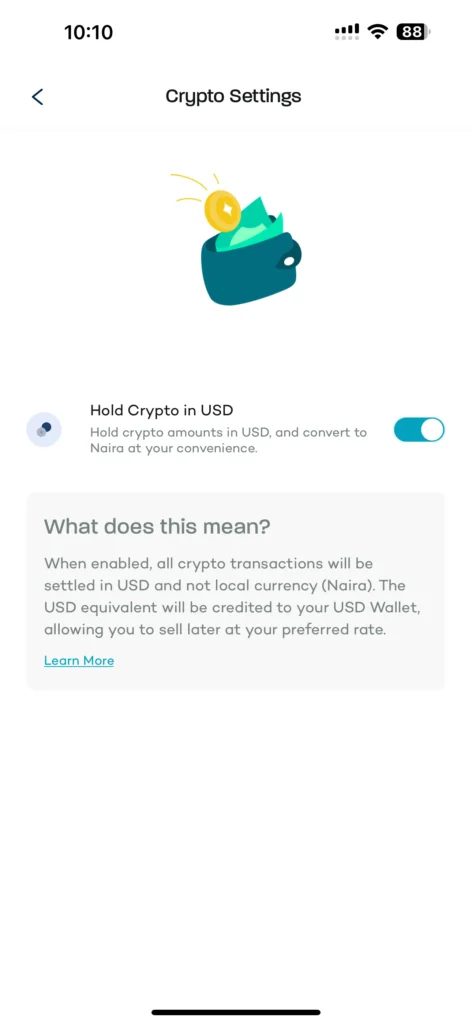

- Hold in USD: Turn on the “Hold Crypto in USD” feature on the app

- Select the crypto you want to convert. Popular options include Bitcoin, USDT, Ethereum, and others.

- Send your crypto to your unique Breet wallet address.

- Wait a few moments. Breet automatically converts the crypto to USD at the best market rate.

- Withdraw your funds. You can move your dollars to your preferred account or hold them within the app.

That’s it. No waiting for buyers or worrying about price fluctuations while chatting with strangers. Everything happens automatically, and your money is ready in minutes.

Related:

Other Benefits and Features of Breet

Beyond easy conversion, Breet offers a range of features that make it stand out:

- Instant processing: No delays or pending trades. Your crypto converts to cash in 287 seconds or less

- Automatic rate optimization: You always get the best conversion rate available at that moment.

- Multi-currency support: You can convert crypto to both USD and local currencies like Naira and Cedis.

- Crypto invoicing: Businesses and freelancers can generate crypto invoices and receive payments directly through the app.

- Secure transactions: Breet uses advanced encryption and two-factor authentication to keep your funds safe.

For anyone in Nigeria who wants a fast, legal, and stress-free way to convert crypto to dollars, Breet is one of the most beginner-friendly options available.