YellowCard is a well-known cryptocurrency company that previously offered retail crypto buying and selling services to individual users in Nigeria and other African markets. For several years, Nigerian users used YellowCard to buy assets like Bitcoin and USDT directly with naira through its mobile app.

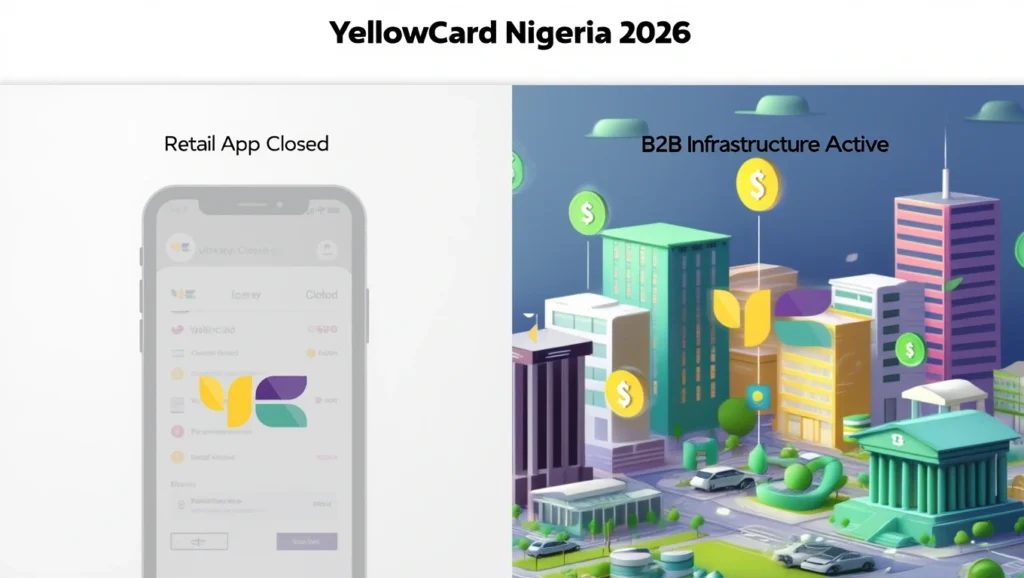

Over time, YellowCard has shifted its business focus. Rather than operating as a retail crypto exchange for individuals, the company has transitioned toward a business-to-business model.

Today, YellowCard positions itself primarily as a crypto infrastructure and payments provider, offering services such as liquidity, on- and off-ramps, and treasury solutions to businesses and institutional clients.

As a result of this pivot, YellowCard no longer provides direct retail crypto services to individual users in Nigeria. However, the company itself remains operational and active in the Nigerian market through its infrastructure offerings.

This article explains what this change means, why YellowCard no longer serves individual users in Nigeria, and how Nigerians can currently access crypto services following this transition.

Related:

- Top 7 YellowCard Alternatives in Nigeria

What Happened to Yellow Card? Does it Still Work in Nigeria?

Yes, Yellowcard works in Nigeria, but no longer for retail crypto to cash or crypto transactions. In November 2025, Yellow Card made an announcement that they were stepping away from retail services. They decided to officially shut down their retail platform, deactivated the mobile app, and transition fully to a Business-to-Business (B2B) model.

By December 31, 2025, the service was basically closed for everyday crypto to cash users.

According to Yellow Card,

“We are closing the Yellow Card mobile app as part of a strategic shift in our business. This decision allows us to fully focus on our core vision: providing institutional-grade stablecoin infrastructure for businesses across emerging markets.

By dedicating our resources to this mission, we can deliver best-in-class treasury, payment, and liquidity solutions for corporate clients.”

Can I Still Withdraw My Funds From Yellow Card?

The official deadline to withdraw funds was December 31, 2025. After that date, it is no longer possible to withdraw via the regular channels. However, the company has stated that funds are not completely gone. They have just been moved into locked accounts. To get them back now in 2026, you have to go through a manual recovery process that involves providing proof of ownership and waiting for their compliance team to verify your identity.

It is a long, tedious process. It is no longer as simple as clicking “Withdraw to Bank.” This is why we always say in crypto, do not leave your money on an exchange. Especially a centralised one. Not your keys. Not your funds.

Related:

- Binance P2P in Nigeria: Top 7 Alternatives

The State of Crypto in Nigeria: What’s Next for YellowCard Former Users?

The exit of Yellow Card from the retail space is not really an isolated event. Over the past few years we have seen multiple cryptocurrency platforms, either pivot or completely sunset.

Paxful has officially shut down due to internal legal battles and massive compliance costs. Binance is technically restricted, with the Nigerian government blocking their domains and making it nearly impossible to use the app without a VPN (which comes with its own security risks).

The Nigerian government has become much more aggressive about how crypto platforms operate. They are suing global giants for economic damage and tax evasion.

Because of this, many platforms are either leaving the country, blocking Nigerian users, or shifting to B2B models where they only deal with approved corporate entities.

This has created a new reality for the Nigerian crypto user. You are now left with two choices:

- Use a VPN that’s really sketchy to access a global exchange and risk your account getting flagged.

- Use a dedicated, locally-compliant platform that is built for the Nigerian reality.

With that said, here is an alternative for YellowCard’s everyday crypto to cash users should consider.

Related:

Why Breet is the Best Alternative to Yellow Card

With Yellow Card moving to the corporate world and Paxful closing its doors, the regular, every day users, hustlers and the freelancers need a new platform to cater for their crypto needs. Cue Breet.

If you were a Yellow Card fan because of its simplicity, Breet is the natural upgrade. Here is the thing though, Breet actually does it better because it also solves the biggest problem Nigerians faced with Binance and Paxful, P2P.

1. Automatic Settlement

Probably one of the coolest features Breet has is Automatic Settlement. You can set your account so that whenever crypto hits your wallet, it doesn’t even stay there. It immediately converts to Naira and lands in your linked bank account. Cool right?

2. Hold Your Crypto in USD

It’s always nice to have options. With the obvious volatility of the Naira, you might not want to convert your money to local currency immediately. Breet allows you to hold your funds in US dollars and store it within the app so you can wait for the best exchange rates before cashing out.

3. Reliability and Security

In 2026, Peer-to-Peer (P2P) trading is a high-risk activity. You are dealing with strangers who might send you “black market” money that gets your bank account frozen by the EFCC.

Or you deal with people who take three hours to confirm a transaction while you are standing at the supermarket waiting to pay.

Instead of participating in the extreme sport that is P2P these days, use Breet. Breet is an OTC (Over-the-Counter) platform. This means you are not trading with a person.

You are trading with an automated system. You send your crypto to your Breet wallet, and the system automatically converts it to Naira at the best market rate. You can even hold in US Dollars if you want and convert to Naira when you feel the time is right.

4. Speed

While many other platforms are busy dealing with court cases and domain blocks, Breet has focused on one thing. Speed. In the time it takes you to boil an egg, your crypto can be converted and sent to your bank. Most transactions settle in under 287 seconds.

That is the kind of reliability we need in 2026.

5. Crypto Invoices

Getting paid for your work as a freelancer or modern business owner can get tedious. Breet has simplified this with its Crypto Invoice feature. You can generate a professional invoice directly from the app and send it to your international clients. The invoice provides a clear, secure way for them to pay you in crypto, which Breet then handles on your end.

It removes the back and forth of which wallet should I send to and makes you look like the professional you are. It is a clean, organized way to run a global business from your phone in Lagos.

People Also Liked:

Safety Tips for Former YellowCard Users

Since the multiple big crypto platforms like Binance, Paxful and Yellow Card are either restricted or gone, scammers are having a field day. They know people are looking for new platforms, and they are setting traps everywhere.

Here are some tips to not become the latest victim

- Fake YellowCard “Agents”: You will come across people on Telegram or WhatsApp claiming to be “official YellowCard agents” who can help you withdraw your Naira since the platform is restricted. This is a 100 percent scam. There is no such thing as an official agent who takes your crypto to give you cash. If you give them your coins, they are gone forever.

- Phishing Links: Because platforms like Yellow Card have sunset their retail activities, scammers are sending emails that look like “Official Yellow Card Recovery Links.” They want you to enter your seed phrase so they can “help you withdraw your funds.” Do not fall for it. Only use the official, verified websites.

- Use 2FA: If your crypto app does not have Two-Factor Authentication (2FA), delete it. In big 2026, a password is not enough. Use an app like Google Authenticator. Do not use SMS 2FA, because SIM swapping is a major issue in the country right now.

Conclusion

Yellow Card did a lot for the early adoption of crypto in Nigeria and Africa as a whole. They made it feel less like a scam and more like a financial tool. But in business, companies pivot.

While YellowCard no longer offers retail crypto services to individual users in Nigeria, the demand for simple and reliable crypto access remains. Nigerians still need practical ways to receive, convert, and cash out cryptocurrencies such as USDT and Bitcoin without relying on complex global exchanges.

This gap has led many users to adopt platforms built specifically for retail use in Nigeria. Services like Breet focus on helping individuals receive crypto through personal wallet addresses and convert those funds directly to naira, without order books or trading interfaces.

As the market continues to shift and companies refine their focus, understanding which platforms serve retail users versus businesses is increasingly important. For Nigerians navigating crypto today, choosing tools designed for everyday use ensures smoother transactions and fewer points of friction.

Don’t Miss:

Frequently Asked Questions About Yellow Card Working in Nigeria

Is Yellow Card Shutting Down?

No. Yellow Card is not shutting down entirely as a company, but it is shutting down its retail app and services for individual users. The company announced a strategic shift to focus exclusively on business-to-business (B2B) stablecoin payment infrastructure and enterprise services. Retail users are expected to withdraw their funds by December 31, 2025, before the app is permanently closed on January 1, 2026.

Is Yellow Card Still Active?

Yes, Yellow Card is still active, but only in a B2B capacity. The platform continues to operate and support institutional-grade stablecoin, payment, custody, and liquidity services for businesses across emerging markets. While individual retail services via the mobile app will end with the December 31, 2025 withdrawal deadline, the company itself remains operational and focused on enterprise solutions.

Can I Still Use Yellow Card in Nigeria to Buy Bitcoin?

No. As of January 1, 2026, Yellow Card has shut down its retail platform. You can no longer buy or sell crypto as an individual user. They now only offer services to businesses and corporate institutions (B2B).

Is Crypto Legal in Nigeria in 2026?

Yes, it is legal to own and trade crypto. However, it is highly regulated. The SEC (Securities and Exchange Commission) now requires platforms to have specific licenses. While trading is legal, the government has blocked several global exchange domains, making it harder to access them without specialized apps.

How do I Withdraw My Money From an Old Yellow Card Account?

Since the December 31, 2025 deadline has passed, your funds are likely in a locked central vault. You need to contact Yellow Card support through their official website, provide your KYC documents, and proof of ownership to initiate a manual recovery.

What is the Best Alternative to Yellow Card for selling crypto?

Breet is currently the top-rated alternative for retail users. It offers an automated OTC system that avoids the risks of P2P and settles directly into Nigerian bank accounts within minutes.