Think about trading cryptocurrencies without having to pass through third parties during transactions. That’s the whole idea of decentralised exchanges.

In the past, crypto transactions could only be carried out on centralised exchanges, which tends to undermine the core concept of Blockchain — decentralisation.

Now, with the rising popularity of Ethereum, the second largest Blockchain network, and the advent of smart contracts, crypto-to-crypto trading has become easier and more anonymous than it’s ever been using Decentralized Exchanges.

What is a Decentralized Exchange (DEX)?

A decentralized exchange is a marketplace where cryptocurrency transactions can occur peer-to-peer, directly between traders. It is called decentralised because it isn’t regulated by an intermediary like banks or the government.

In contrast to centralised exchanges, you control the private keys when interacting with a decentralised exchange. This basically means the security of your funds is solely in your hands.

Now, let’s examine how a DEX works to understand the technology that powers this great innovation and explore how to use it.

How Does a Decentralized Exchange Work?

Decentralised Exchanges work via a set of smart contracts that come together to form the protocol.

Crypto-to-crypto transactions are made at established prices obtained from price oracles using an algorithm. A liquidity pool provides liquidity to fund these numerous transactions, which are enabled by smart contracts.

Transactions on a DEX are entered directly into the Blockchain rather than an internal database, as in Centralized Exchanges.

In Centralized Exchanges like Binance or Huobi, transactions are performed peer-to-peer via an order book.

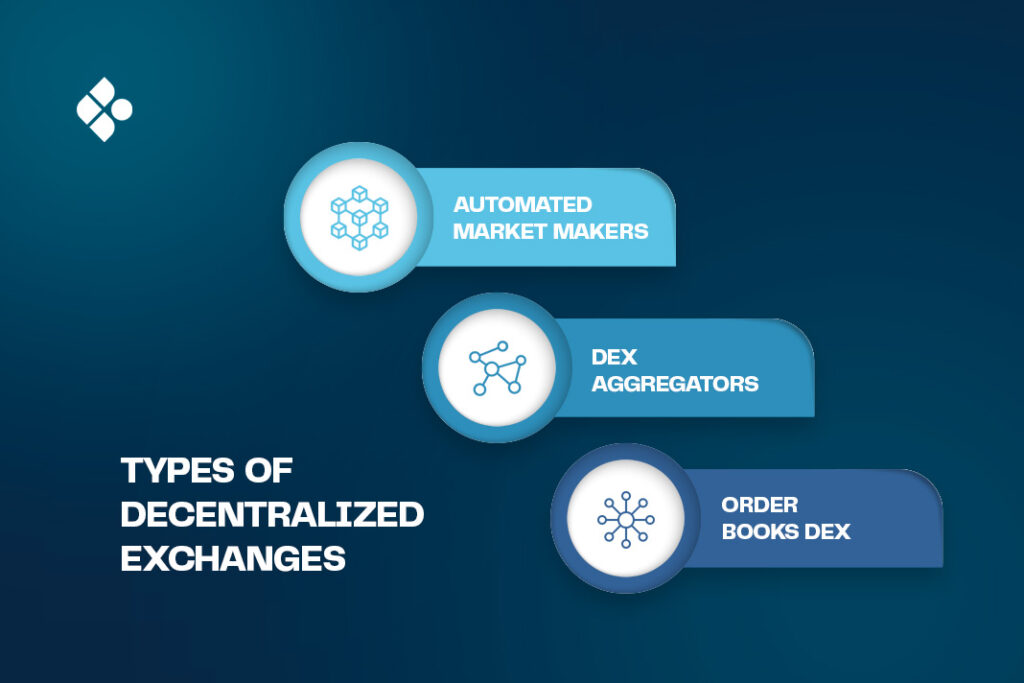

Types of Decentralized Exchanges

There are three major types of Decentralized Exchanges. They are as follows:

- Automated Market Markers (AMMs) :

AMMs are the most common type of DEX. They provide instant access to crypto-to-crypto trading pairs facilitated by their instant liquidity pools.

Think of an AMM as a bot that quotes prices for each crypto transaction based on the information it gets externally from price oracles like Chainlink’s Price Feeds.

The exchange rate here is determined by the associated smart contracts.

The most popular AMMs are Uniswap and Pancakeswap. Others include STONfi, DeDust, dYdX, Raydium, and many more.

- Order Book DEXs:

As the name suggests, it is a type of DEX that uses order books. Unlike CEXs, these order books are fully on the chain.

This type of DEX is usually less common because it requires a lot of resources to enter each transaction on the order book into the blockchain.

This process usually also leads to security issues. A popular example of an order book DEX is dYdX.

- DEX Aggregators:

This type of DEX simply loops through other DEXs and finds the best price for each transaction. Because it sources its liquidity from other DEXs, it is generally faster and provides cheaper gas fees.

Even though the concept is new, these Aggregates have enjoyed widespread success and are mostly used to trade retail amounts quickly. The biggest DEX Aggregates currently are 1 inch.

Decentralised Exchange Risks and Considerations

As with most things, there are several risks and factors to be considered when using a DEX. They include:

- Smart Contract Risk:

DEXs are powered by a collection of smart contracts; hence, any inherent vulnerability in the code can lead to massive fund losses to the protocol. DEXS must undergo regular audits to keep its code base secure and up to date.

- Liquidity Risk:

Liquidity providers constitute a significant component of DEXs. While this may not seem like an issue, the fact that it is needed is still a concern for its future. DEXs are still relatively new and don’t have the transaction volume that CEXs enjoy yet.

Also, there is a possibility of impermanent loss associated with liquidity pools, which may affect the value of your initial investments in liquidity pools. Impermanent loss occurs when price fluctuation within a pool leads to a temporary loss of accrued profit.

- Front Running Risk:

The Blockchain is transparent, and DEXs publish transactions directly on it. Hence, someone with advanced knowledge can use pending transactions to siphon funds using front-running techniques.

- Centralization Risk:

Decentralisation is the major selling point of a DEX, but factors like the government and legal bodies can introduce a centralisation risk. Based on location, a DEX protocol can be controlled in certain aspects, like taxes, by law. This will eventually lead to concerns about the security and fairness of the entire protocol.

- Network Risk:

This risk relates directly to the cryptocurrency network(s) on which the DEX operates. The DEX inherits all the issues from the parent network. Issues like high gas (from ETH), network congestion and downtime (from Solana), smart contract vulnerabilities, and slow processing times may affect the DEX, which uses these networks.

- Token Risk:

Because DEXs are decentralised and trustless, anyone can create a token and publish it for trading on a DEX.

These tokens pose risks to DEX users and the DEX itself. Token issues arising from security vulnerabilities, price volatility, and the token’s liquidity will affect the DEX and its users.

Pros and Cons of Using a DEX

Using a decentralised exchange comes with the following advantages and disadvantages.

Pros

- Anonymity:

DEXs don’t require a KYC process, and users can interact with them via wallet addresses. This provides a much higher level of anonymity than in CEXs.

- Reduced security risks:

Security risks related to scam traders and other centralised points of failure are almost zero in a DEX. Users interact directly on the Blockchain via the DEX’s smart contracts.

- Reduced counterparty risk:

DEXs require no intermediaries or third parties, hence the limited risk of mismanagement or insolvency of third-party funds.

Cons

- Smart Contract Vulnerabilities:

DEXs are powered by smart contracts, usually written in Solidity. Thus, they are susceptible to code vulnerabilities that can lead to fund loss.

- Unvetted token listings:

As a result of being automated, there is little to no vetting process to list new tokens.

This can lead to the creation and listing of fraudulent tokens designed to drain wallets or steal funds from the protocol.

- Specific knowledge required:

To use a DEX, one usually needs specialised knowledge of crypto wallets, liquidity pools, and crypto bridges. Since the entire process is automated, funds lost due to a user’s mistake cannot be recovered.

Frequently Asked Questions (FAQs) About Decentralized Exchange

Is Binance a centralised or decentralised exchange?

Binance is a centralised exchange. You need to input personal details to get verified for trading on the platform, and the exchange has a record of assets you keep with them.

Are DEXs safe to use?

Yes, Decentralised Exchanges are safe as long as you have relevant knowledge of how they work and avoid investing without doing your own research.

What is the difference between DeFi web apps and a DEX?

A DeFi application provides numerous financial services, while a DEX is solely for a crypto-to-crypto exchange.

How many DEXs are in crypto?

There are currently countless DEXs in the crypto space on different networks, and new ones spring up every few days.

How do DEXs make money?

Most DEXs generate revenue through trading fees and endorsements. Another popular method is through rewards from providing liquidity.

Conclusion

Decentralised Exchanges offer a route for the average person to invest in specific cryptocurrencies quickly. Their decentralised and trustless nature ensures a high level of anonymity for users.

However, DEX use also comes with the disadvantage of listing scam tokens and inherent network risks. You can mitigate these risks by doing your research on each token you want to interact with and taking your time to understand the concepts that come together to make a DEX work.